Renters Insurance in and around Visalia

Welcome, home & apartment renters of Visalia!

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

- visalia

- tulare

- farmersville

- exeter

- woodlake

- hanford

- lemoore

- delano

- porterville

Protecting What You Own In Your Rental Home

Trying to sift through savings options and coverage options on top of family events, keeping up with friends and work, can be time consuming. But your belongings in your rented house may need the remarkable coverage that State Farm provides. So when mishaps occur, your furniture, videogame systems and linens have protection.

Welcome, home & apartment renters of Visalia!

Rent wisely with insurance from State Farm

Renters Insurance You Can Count On

You may be wondering: Is renters insurance really necessary? Imagine for a minute how much it would cost to replace your personal property, or even just a few of your high-value items. With a State Farm renters policy behind you, you don't have to be afraid of thefts or accidents. But that's not all renters insurance can do for you. It extends beyond your rental space, covering personal items you've placed in a storage closet, on your deck, or inside your car. Renters insurance can even cover your identity. With so much of your life accessible online, it’s important to keep your personal information safe. That's where coverage from State Farm makes a difference. State Farm agent Justin Mosley can help you add identity theft coverage with monitoring alerts and providing support.

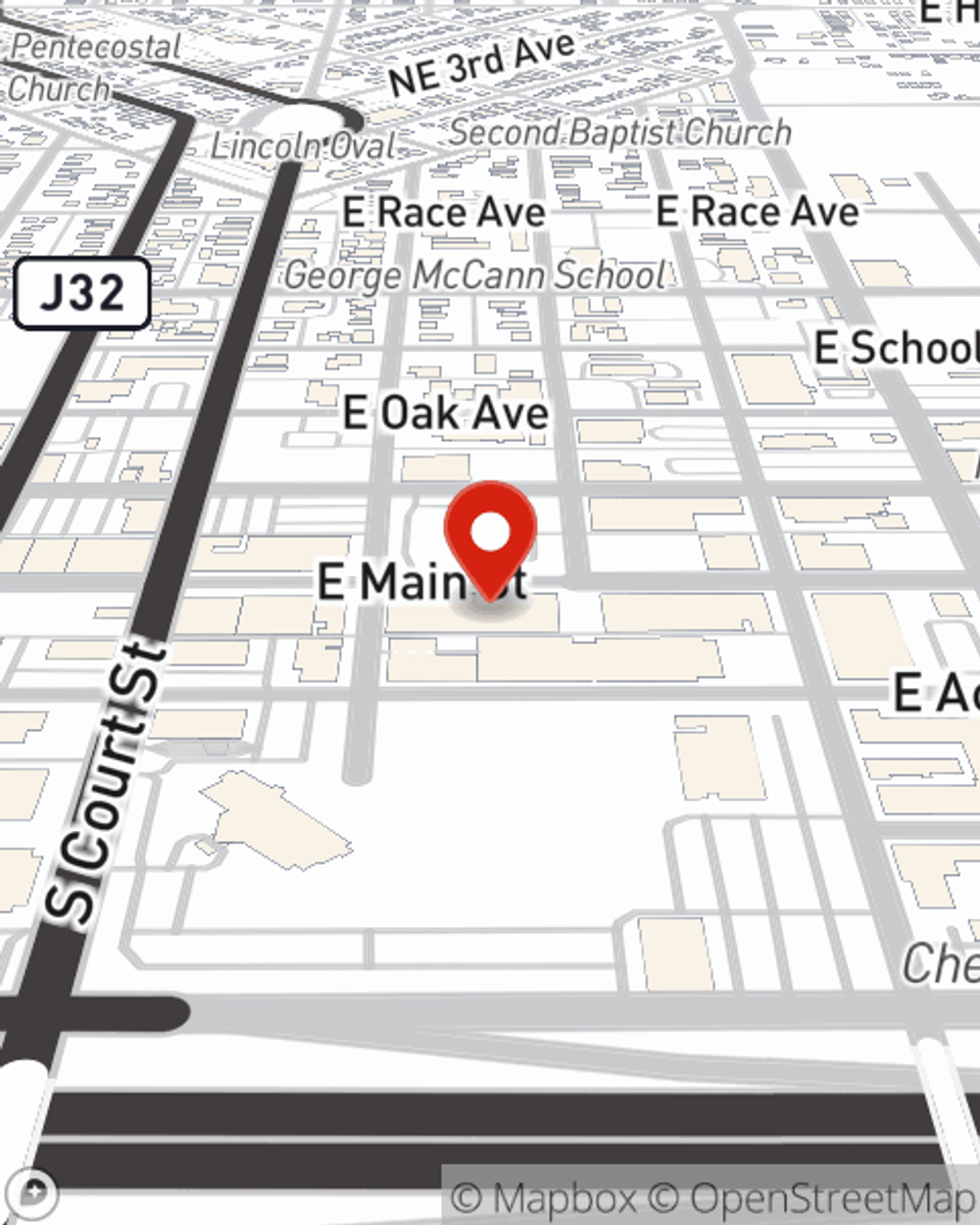

State Farm is a value-driven provider of renters insurance in your neighborhood, Visalia. Visit agent Justin Mosley today for help with all your renters insurance needs!

Have More Questions About Renters Insurance?

Call Justin at (559) 688-1888 or visit our FAQ page.

Simple Insights®

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

Justin Mosley

State Farm® Insurance AgentSimple Insights®

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.